SPEND? Or END.

The aeonian debate of supply.

Quick note: I will be discussing two tokens created for this web-app. Feel free to check it out first before proceeding with this read.

Its a fascinating topic that has plagued most of the blockchain space for a while now; and I’ll admit, it did rile me too during my initial stages of designing the smart contract. Initially, I was all in on END; this idea of finality and absolution, where a tokens supply is fixed and unchanging, just like the world I was so desperate to live in. It says a lot about the human psyche, and how we are so driven to act against something so unchanging such as the unending drift of reality.

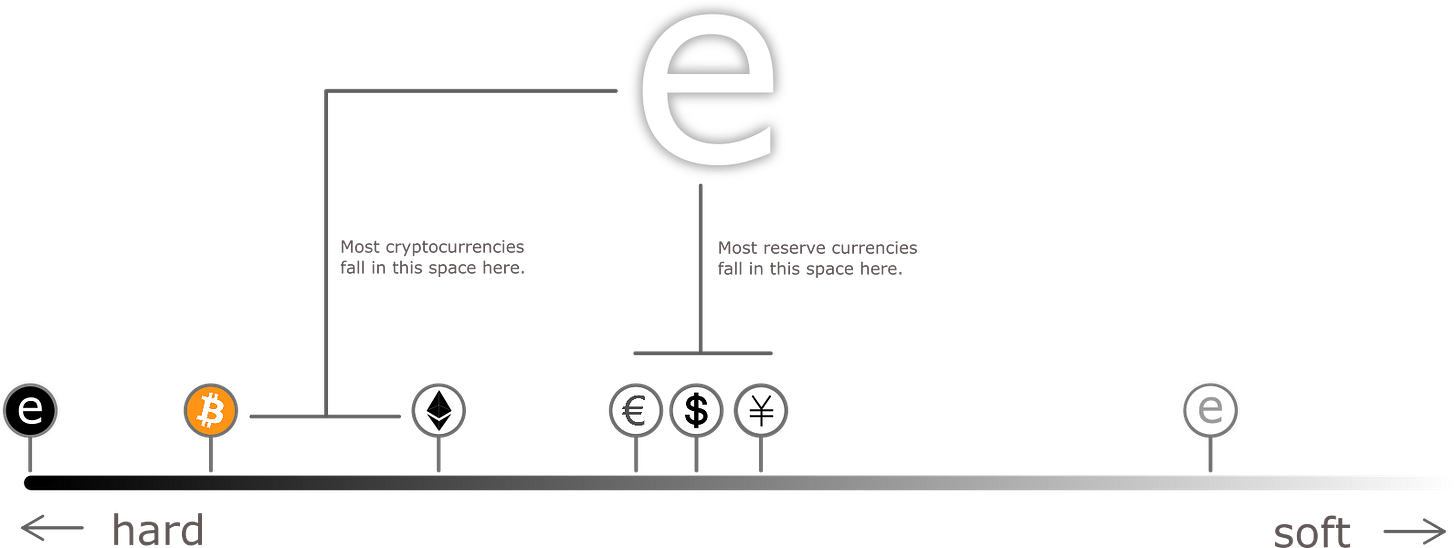

Which is better? a capped token or an uncapped token. Well, depends on the context of course; is it a token you wish to pay some validators to secure and verify your ledger? then uncapped of course, otherwise, capped. Typically, capped tokens are hard assets, assets whose value are pegged to a certain condition of reality; I discussed it at length in my previous post. The main difference between the two types of tokens is value transfer; when I acquire a token through its predefined means of supply, who is gaining and who is losing value? With SPEND, whenever I mint my pre-allocated amount into my account, I am effectively transferring a fraction of all the spendable value from all the rest of the accounts into my account; with the value being all the value that was injected into the token through its direct exchange in other transactions. On the other hand, with END, the value transfer is more direct, since its only mode of access is purchasing. The two are polar opposite in configuration, and serve as the logical extreme versions of each asset class. Most of everything else out there exists in the middle of the spectrum that comprises these two asset classes.

Notice how SPEND isn’t completely on the right side, owing to the fact that you need to pay a transaction validator some ether to write the mint action on the blockchain for you. END is completely on the left side, because you can only buy it from the smart contract’s built in END Exchange which holds the initial total supply of the token; more cryptocurrencies should do this, owing to how easy it is to implement a basic price action function on a smart contract. This polarized approach to creating the two tokens is what make them really good, and by leveraging both together, you get the best of both all at once. So while most other assets force you into a fixed and unchanging mixture of the two, E5 allows for dynamic control between which proportion of each asset type you prefer to use. Transactions require context, and context is important when assessing which asset type to use and with what magnitude. Right now today, we’re limited to using just one asset type, that being normal ordinary cash; and again, I’m using the term 'asset' very loosely here to denote all objects or commodities of perceptual value; on E5, that number goes up to two.

Think of END as an extreme implementation of the functional value of gold in the context of absolute long term value retention, and SPEND as an extreme implementation as the functional value of probabilistic short term value expression. Now of course on e (e is an informal name for E5) you’re not just limited to the two assets, since you have the capabilities to create your own asset and use just that for your day to day transactions. Let’s take one interesting application of hard money, collateral. In the cryptocurrency space, using ether and other hard assets as collateral for minting stable coins is already a normal thing; though they tend to prefer over-collateralizing to account for market volatility and turbulent price action in active exchanges. You know, the thing about volatility is that, they say it’s the cryptocurrencies that are volatile in value, but the case can also be argued for our normal everyday reserve currencies; maybe its our cash thats volatile. Think about it; the supplies of most cryptocurrencies are stable, predictable, accounted for and properly audited by the public. While the supplies of normal everyday currencies are unpredictable, unaccounted for and not audited by the public. I mean, we have official metrics such as M1, M2 and the such, but if you examine the financial system as a whole, its practically impossible to measure the exact supply of the currencies we use today; and by currencies I mean spendable currency, cash and all forms of credit.

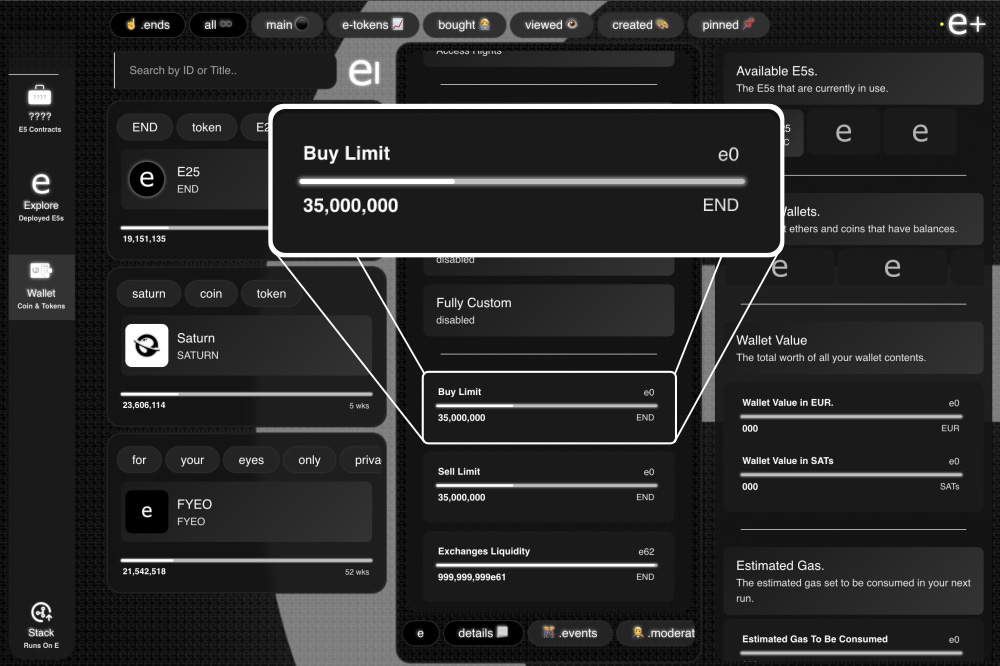

That aside, collateral is a functional exchange of access; access to liquidity in exchange for value accrued from its compounded use. I’m exchanging access to my END, for instant access to cash in the form of credit, which I will then return with interest, for my END. The function of END in this context will be to just maintain and appreciate in value; an asset in which, if I were to lose all my debtors, I will still have access to a vast amount of value which is guaranteed to appreciate in value indefinitely, relatively to all forms of currency such as SPEND. Notice how the equation would be perfectly balanced if the value of END you would receive as collateral would appreciate at the same rate as the compounded interest of the credit issued to the debtor. For instance, if 10,000 SPEND worth of END was offered in exchange for 10,000 SPEND in credit at 1% interest p.a., a 1% appreciation of END every year would cover for the interest, making the loan virtually risk free; and if the appreciation rates were higher, then a higher amount of SPEND could have been offered for the END provided. Of course this would result in END being used in day to day transactions alongside SPEND, and the need to accrue END for these types of transactions would persist. By the way, this is the main reason why that buy-limit is enforced on all transactions looking to acquire END; to enable these types of transactions.

Since a relatively high amount of ether is issued to miners for validating new blocks and a relatively high amount of ether is available for purchase in those exchanges, a limit is required to ensure that a steady increase in active supply in END is made to stabilize its price relative to the ether used to buy it, and to maintain its scarcity. It will be interesting to see the dynamics in the credit markets on e that use END as collateral, and this will very much stay in the realm of debate; the battle for collateral supremacy.

I touched on bitcoin’s future in the last post, with an interesting claim that the number of miners actively supporting the network would decrease with a decrease in the amount of bitcoin issued out after every new block to the block’s validators. It all comes down to the main narrative that bitcoiners today push out when it comes to use of the network as a whole; the whole “buy and hold” argument. At first the logic is sound, I mean you buy and safely store it in your wallet, and over time the price would appreciate making your investment sound. It’s worked well for the last ten years, whose to say that it wont last forever, right? When you tell someone to buy and hold, you’re actively discouraging them from ever using the blockchain itself, by telling them to keep their coin in their wallet and never use or spend it; essentially avoid writing data and transactions on the blockchain.

This might sound good because it helps keep the blockchain’s block-space available for everyone to use at relatively low network fees, but this forces miners to actively rely on block-rewards to pay for their hardware and energy bills while maintaining the network, rewards that are actively slashed every 4 years with a near religious promise that eventually they wont even be a thing anymore. I hope you see the problem now with lower and lower block rewards overtime on a network that isn’t really being used. Mining bitcoin is prohibitively expensive if you wish to be profitable, and once you take away the network incentive that is that block-reward, most miners will check out entirely and switch to securing another network or shutdown entirely, leaving only the larger players with expensive mining infrastructure in an effectively centralized network. A great alternative to this would be tail-emitting, issuing out a fixed low amount of bitcoin indefinitely to encourage miners to keep securing the network and adding blocks to the blockchain if it is receiving a relatively low amount of traffic.

Hard-capping a coin you wish to use to secure a network is a bad idea, but for deployed tokens on existing networks such as ethereum, that is perfectly fine. I highly encourage all the capped coins out there who actively maintain a network by paying miners or validators, to uncap their token and tail-emit; just one ether or one coin per block indefinitely is perfect. An even better approach is creating two tokens, each with individual distinctive characteristics of their own but ultimately identical utility on your system. In the case for E5, END is meant for testing the system and seeing if it works well for what they need, and SPEND is for real and heavy use since it allows for less ether expenditure; END is bought using ether while SPEND is just minted, ultimately using less ether overall.

The mechanics of END is pretty cool once you understand the entire design, and at the heart of END lies its exchange; I usually refer to it as the first exchange because its the first tool you make use of when using the app for the first time. Basically, if you wish to acquire END, you do so through the first exchange, or the END exchange; an exchange built into E5 and it’s smart contracts with no middlemen. It’s like a built in Uniswap, specifically for tokens minted on the smart contract. When you purchase END, you purchase using ether at a price of 1 billion and one wei per END; everyone including the smart contracts deployer has to go through the END exchange to acquire END. END is what the ethereans and bitcoiners would refer to as a ‘deflationary’ asset, you burn a fixed percentage of the amount you’re handling when you spend it from special escrow accounts called contracts. The idea behind this burning is to actively drive up the scarcity of END while in use, and this should in turn result in an increase in the price of END on secondary markets such as centralized exchanges outside of e, owing to the disparity between the presented value and the actual value drawn from the utility backing the token itself.

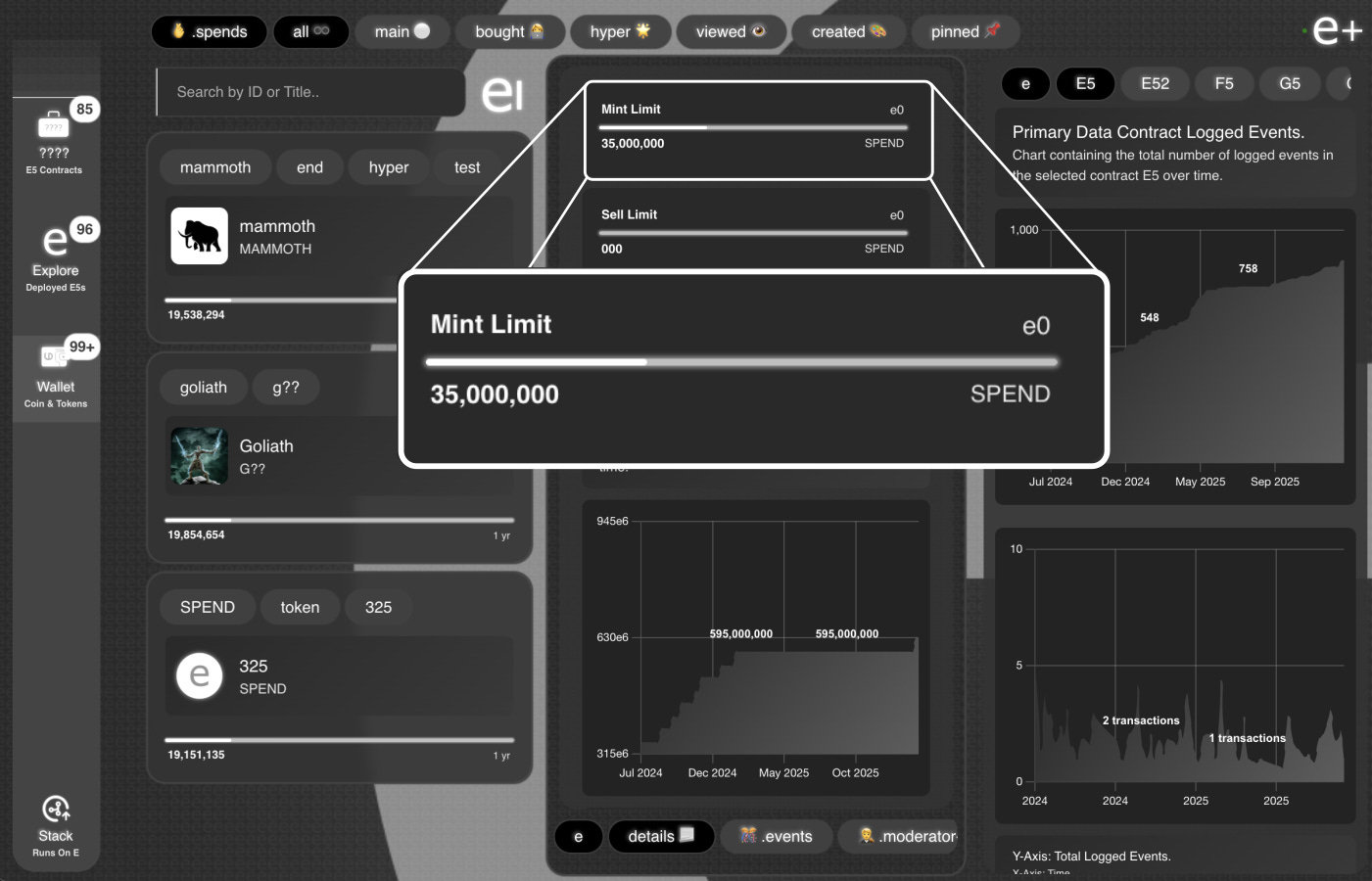

SPEND is a much different creation. Rather than drawing its scarcity from an underlying asset, that being ether, it creates its own scarcity through internal mechanisms that actively monitor and adjust its issuance by measure of its demand. Basically, the more accounts that wish to mint it at a given block, the less each account receives, with the first minters in line receiving slightly more than the last minters of a block in an exponential decay supply curve. For instance, in a given block, the first minter would receive the starting 1000 SPEND, then the next would receive 990 SPEND and the minter after that would receive 980 SPEND and so on. The actual starting amount is variable, and is set to 35 Million SPEND on E5.

The mint limit is adjusted in the proceeding block, depending on the extent to which the supply of spend was increased in the preceding block. So if the SPEND Exchange targets an increase of 3000 SPEND per block and the supply went up by 6000 SPEND for instance, the mint limit would be reduced by a certain percentage. This allows the exchange to control the supply of SPEND based on its demand relative to itself and to maintain its stability, aside from the normal minting restrictions such as a time, block and contract limits; you can only mint it every 3 days, and after making 4 or more transactions on e, and after entering one contract or more, and also have a minimum of 1 transactions already made on e to mint for the very first time. These limits are enforced to ensure that the token is actually being spent and used inside the application and contracts, and deter what I refer to as ‘slack-minters’; folks who mint and sit on their SPEND without using it.

So both tokens are scarce and both tokens have some utility within this self-contained system of E5. Which one should I use?

Check out my cool progressive web-app if you're into these kinds of ideas.

e.